This post will take a look at some interesting aspects of the Fairview Meadows development. It consists of two tracts of land located between US287 and Pioneer Road; the southwest corner of New Fairview. The first tract of 634 acres (550 lots) isn’t in the city limits. It’s in the New Fairview ETJ (Extraterritorial Jurisdiction- ETJ, is a one half mile wide border around the city limits that allows cities to have some control of how the ETJ area is platted and developed). The second tract, called “Fairview Meadows North” consists of 313 acres and is in the city limits; bordering the north side of the first tract. It is planned to have a greater lot density (364 lots), a park, and green space.

The city of New Fairview issues building permits and inspects as if the development was wholly located within the city. This is a common practice when a developer needs a city’s consent to form a Municipal Utility District (MUD) to fund construction of public infrastructure. The December 3, 2018 Development Agreement is the controlling document between New Fairview and Lackland Fairview, LLC for Fairview Meadows development.

The “New Fairview Municipal Utility District #1” funds the construction and maintenance of public infrastructure (roads, water, and sewer). The MUD is an independent entity and governed by a Board Of Directors. To be qualified to serve as a director, a person shall be at least 18 years old, a resident citizen of the State of Texas, and either own land subject to taxation in the district or be a qualified voter within the district.

The Developer Agreement does have some provisions worth noting.

- The City has the right to annex the property upon the earlier of (a) twenty years from the effective date, or (b) the date that construction of public infrastructure to serve 100% of the property is completed and bonds have been issued.

- The MUD shall not issue any bonds, notes, time warrants, or other obligations with a term greater than 30 years from the date of initial issuance.

- The MUD shall not issue obligations to fund or reimburse the cost of constructing public infrastructure for the property in excess of forty million dollars.

- The MUD shall give notice to the City of its intent to issue bonds and the material elements of a proposed issuance of obligations, including the amount and length of the debt obligation, prior to issuance of the obligations.

Currently an amendment to the Developer Agreement is in the works for Fairview Meadows North platting and increasing the allowable bond limit from $40,000,000 to possibly $90,000,000.

I am not convinced that the annexation provisions within the approved 2018 agreement are still legally viable. The Texas legislature disallowed forced annexation in 2019. Future ETJ property owners might not want to annex into New Fairview. Annexation could be beneficial to Fairview Meadows residents. The city would, upon annexation, assume the existing MUD debt and dissolve the MUD. Beneficial because debt spread among a larger property tax base calculates to a lower tax rate. The City would have to wisely analyze the assumed debt payments against new tax revenue generated by annexation. It is imperative there should be no increase of the city tax rate due to annexation.

The current fiscal year, 2023/2024, New Fairview city ad valorem tax rate is .258013 per $100 valuation ($258 per $100,000 valuation). Whereas Fairview Meadows residents 2023 MUD ad valorem tax is $1 per $100 of valuation ($1000 per $100,000 valuation).

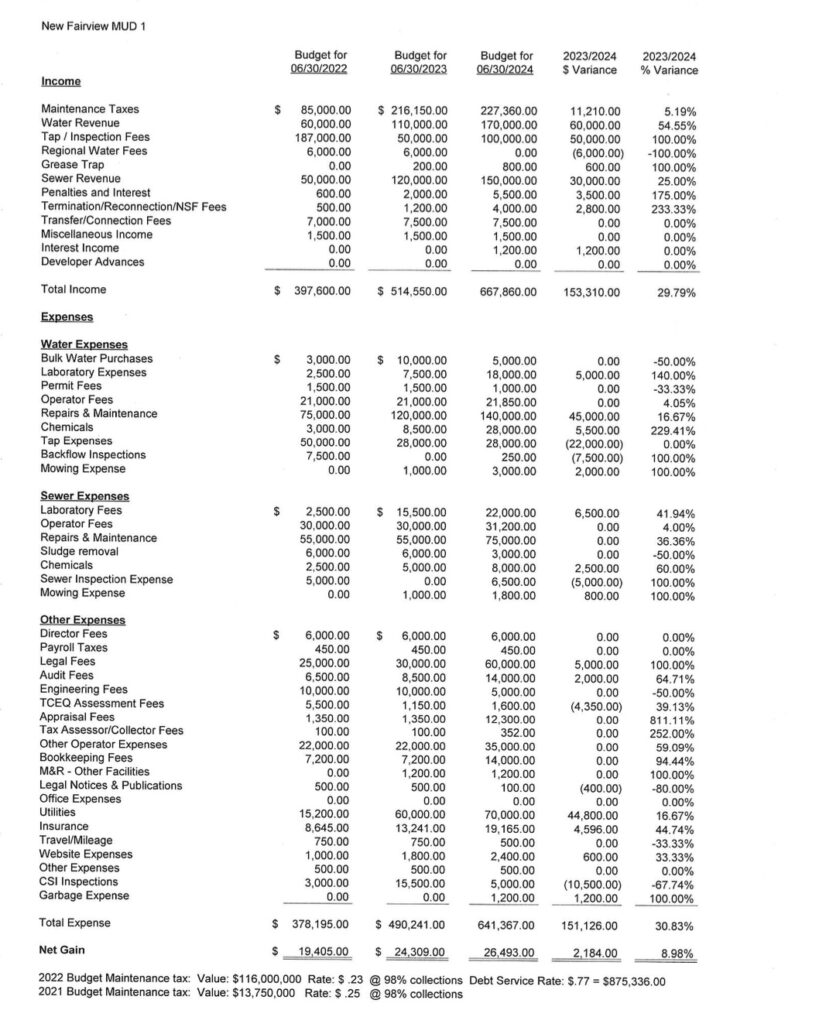

Below is an image of the MUD 2024 budget; accessible from the bottom link.

The 2018 Fairview Meadows Developer Agreement is available at New Fairview City Hall with an open public records request.