Copied from the 2023/2024 budget opening. Link at bottom for full budget.

“FY 2023 – 2024 Budget Message

TO THE HONORABLE MAYOR AND MEMBERS OF THE CITY COUNCIL

Introduction

As required by the Texas Local Government Code, I respectfully submit to you for your

consideration the annual operating and capital budget for the fiscal year beginning October 1, 2023 and ending September 30, 2024. This budget has been developed to allocate available resources to accomplish the goals and objectives of the City Council and City’s Boards and Commissions. This year’s budget focuses specifically on addressing the City Council Strategic Goals and Objectives that were adopted on March 20, 2023, including: infrastructure, public safety, code enforcement, managing growth, parks and beautification, and fiscal responsibility.

The budget addresses the operational impact of taking on the City of Boyd’s Municipal Court

operations through a recent Interlocal Agreement (ILA). This includes the addition of a full-time Permit Tech/Admin Assistant in the Municipal Court Department, an increase in department operational costs, and projected revenue growth based on the significant rise in court activity.

There is also a part-time Permit Tech/Admin Assistant in the City Secretary Department to assist with the transfer of a large volume of information to a new integration software system, FundView, and to assist with increased permit activity. There is also the addition of a full-time Public Works Tech in the Public Works Department to assist with street and drainage, park maintenance, and code enforcement.

The budget also has a significant increase in the amounts paid to East Wise Fire Rescue and Justin Community Volunteer Fire Department for the fire protection services. It also works on the assumption that the City will soon have an Interlocal Agreement with the City of Boyd for law enforcement services. Specifically, for the enforcement of city ordinances and of traffic laws within the community. This ILA will have a significant increase to the Public Safety Department

budget, but it also has a significant impact to the projected revenues for Municipal Court.

The budget also contains a salary adjustment, up to five percent (5%) for all employees to keep City positions competitive with surrounding communities and help with retention.

The budget takes into account the dis-annexation of the Falcon Ridge subdivision from the city, which this year is equivalent to a certified taxable value of a little over $85 million. This resulted in a significant decrease in the amount of property tax the City is collecting compared to the previous fiscal year. However, per state law, the property owners in the Falcon Ridge subdivision will still receive an assessment for their share of debt service that is required due to the issuance of debt that occurred when they were part of the city. All of the funds collected will go directly into the Debt Service Special Revenue Fund (Fund 04).

The budget also includes the debt service payments resulting from just under $3.5 million in Certificates of Obligation issued on Auguste 7, 2023. As part of that issuance, $75,000 will be transferred from the Transportation Impact Fee Special Revenue Fund (Fund 05) to the Debt Service Special Revenue Fund (Fund 04) to cover the debt service payment for Graham Road 8 improvements. Between the 2021 CO and 2023 CO Bonds, the debt service payments this year will total $436,278.06.

Formation of the Budget

The proposed budget was developed through an extensive process of meetings with department heads, reviewing of requests received by city departments, and then prioritizing those requests in a manner that utilizes resources effectively, within fiscal constraints, while working to achieve

the City’s strategic goals and objectives. A budget calendar was implemented to ensure

numerous discussions with the City Council to seek input, and to make sure that statutorily

required dates are met for public notices, public hearings public, and tax rate and budget adoption. Below is the calendar that was followed for this proposed budget.

- June 5- Budget Workshop at Regular Council Meeting

- June 19- Budget Workshop at Regular Council Meeting

- July 17- Budget Workshop at Regular Council Meeting

- August 7- Budget Workshop at Regular Council Meeting

- August 18- File Proposed Budget

- August 21- Budget Workshop at Regular Council Meeting

- August 24- Publish Notice of Budget & Tax Public Hearing

- September 5- Adoption of Tax Rate and Budget at Regular Council Meeting

- September 29- Final Date to adopt a Budget

Proposed Tax Rate

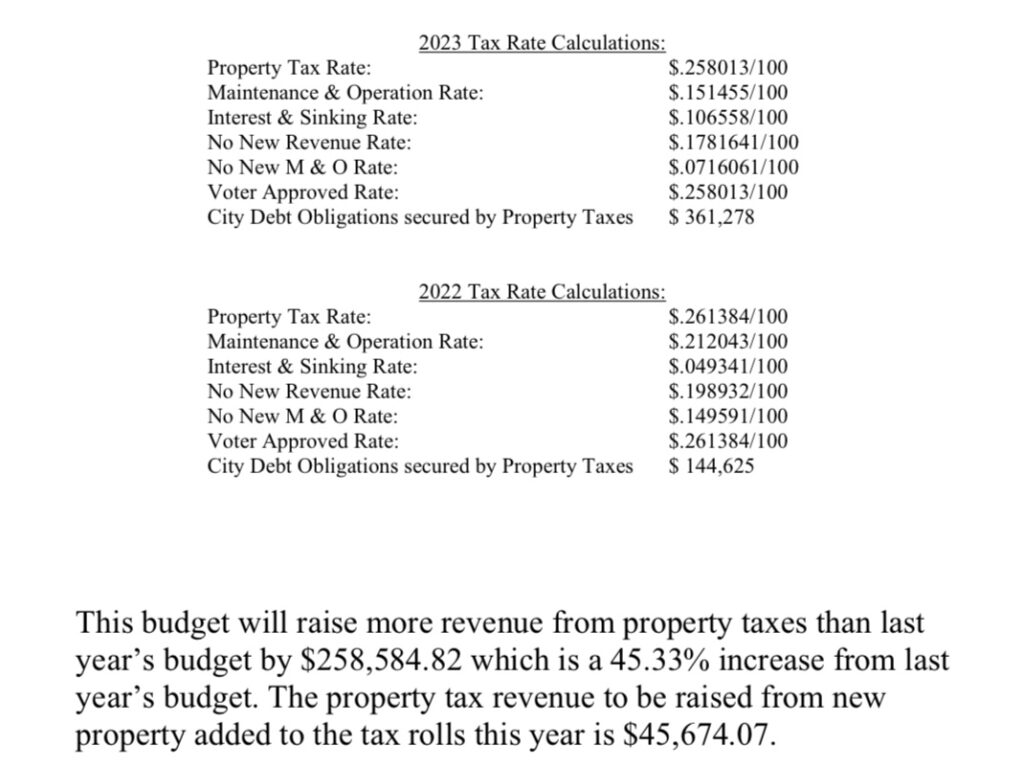

This budget is based on a voter approved tax rate of $0.258013/100. The voter-approval tax rate is the highest tax rate that a taxing unit may adopt without holding an election to seek voter approval of the rate. The voter-approval tax rate is split into two separate rates:

- Maintenance and Operations (M&O) Tax Rate: The M&O portion is the tax rate that is needed to raise the same amount of taxes that the taxing unit levied in the prior year plus the applicable percentage allowed by law. This rate accounts for such things as salaries, utilities, and day-to-day operations. The proposed M&O Tax Rate is $.151455/100.

- Debt Rate (Interest & Sinking (I&S)): The debt rate includes the debt service necessary to pay the taxing unit’s debt payments in the coming year. This rate accounts for principal and interest on bonds and other debt secured by property tax revenue. The proposed I&S Tax Rate is $.106558/100.

This proposed tax rate is a $.258013/100, which is a $.003371/100 decrease from the current $.261384/100 tax rate.

Funds

City departments operate out of the General Fund, which provides what most citizens consider to be basic city services. This budget contains the following departments: City Council, Administration, City Secretary, Municipal Court, Planning and Development, Public Works, Code Enforcement, Public Safety, and Parks & Recreation. The budget also contains several Special Revenue Funds including the Debt Services Fund; Transportation Impact Fee Fund; Court Security Fund; Local Truancy Prevention Diversion Fund; Jury Fund; Court Technology Fund; Parks Grant Fund; and Capital Improvement Projects Fund.

Budget Highlights

On March 20, 2023, the City Council adopted a Strategic Plan with six Strategic Goals and seventeen (17) Strategic Objectives aligned with the City’s mission and vision statements. Many hours were invested in the creation of this Strategic Plan, including the creation, implementation, and results tabulation of a New Fairview Citizen Survey. The Strategic Plan is an all-encompassing systematic approach that permits the current and future City Councils the ability to best allocate the resources entrusted to the City by our citizens. It gives the City the ability to prioritize the actions that have to be taken in order to meet the overall goals that we need to fulfill in order to generate the results that the citizens expect and deserve. The Strategic Plan is also used in daily operations and in budget discussions. The budget focuses on several City Council goals and objectives including the following items that are found in the budget.

Strategic Goal 1 – Protect the Public

Objective 1.2 – Improve Code Enforcement: We are working on contracts forabatement of code violations where we cannot gain voluntary compliance ($5,000). The addition of 1 full-time equivalent (FTE) in Public Works will help free up time for our Code Enforcement Officer to do more enforcement activity. This will also allow the City to being training of another staff member to become a licensed Code Enforcement Officer ($39,520). The new fleet truck in Public Works ($85,000) will free up use of the current F350 truck to be used as a Code Enforcement vehicle.

Objective 1.3 – Grow Public Safety Services: There is an increase in the Public Safety Department budget for the amounts paid to both East Wise Fire Rescue (EWFR) and Justin Community Volunteer Fire Department for the annual fire service contracts ($73,800). The budget also assumes that an Interlocal Agreement will be approved with the City of Boyd for law enforcements services ($70,000). There are also funds for the addition of six bunker gear lockers that will be installed in the Multipurpose Building as requested by the EWFR Fire Chief. There are also funds to replace three Multipurpose Building bay door openers for EWFR and/or Wise County EMS ($16,500).

Strategic Goal 2 – Invest in Infrastructure.

Objective 2.1 – Better Roads and Drainage: Again, the addition of one FTE in the Public Works Department and the addition of a new fleet truck in Public Works will promote more efficiency and the ability to complete more road and drainage projects. We will maintain our two part-time Public Work Techs ($40,452) and have funding for road maintenance materials ($40,000). The improvements to the equipment storage area and materials yard behind City Hall will help with operational efficiency on road and drainage projects for the Public Works Department ($32,000). The budget also contains the $3.5 million resulting for the issuing of Certificates of Obligation (CO) for road and drainage reconstruction projects in the Chisholm Hills subdivision, Graham Road, and enhanced maintenance to roads in the Sky View Ranch and/or Rio Rancho Estates subdivisions.

Strategic Goal 3 – Manage our Growth.

Objective 3.1 – Respect for our rural heritage: The Code Enforcement/Health Department budget has funds for the newly created Keep New Fairview Beautiful (KNFB) Committee to use for beautification projects ($5,000). There are also funds for KNFB to work with a consultant to apply for a TxDOT Green Ribbon grant or Governor’s Excellence Award grant ($12,000) for further beautification projects at our entrance corridors.

Strategic Goal 4 – Exercise Fiscal Responsibility.

Objective 4.1 – Sustain a low Property Tax Rate: The budget has a proposed tax rate that is equivalent to the Voter-approval tax rate ($0.258013/$100). This tax rate is a $.003371/100 decrease from the current $.261384/100 tax rate. This tax rate will cover the debt service payments for the new issuance of $3.5 million in CO Bonds, does not reduce city services, and absorbed the loss in taxable value with the dis-annexation of the Falcon Ridge subdivision ($85 million).

Objective 4.2 – Seek grant opportunities: The City has applied for another TexasCommunity Block Grant (TxCDBG), which if awarded will result in $500,000 that will be used for the road and drainage reconstruction of Latham Lane. There is a local matchof $10,000 for this grant. The City will seek another Rainwater Harvest Grant next year, and a TxDOT Green Ribbon grant or Governor’s Excellence Award grant.

Objective 4.3 – Seek interlocal opportunities: The recently entered into an Interlocal Agreement (ILA) with the City of Boyd’s to take over their Municipal Court operations. The budget reflects the increased operational costs to our Municipal Court for the Municipal Judge, Municipal Prosecutor, and the addition of one FTE Permit Tech/Admin Assistant to the department ($45,100). The budget also includes the increase in revenues ($75,000) to the City resulting from this ILA. The City is working with the City of Boyd on an Interlocal Agreement for law enforcement service that could cost the City approximately $70,000 but could also generate approximately $150,000 to the Municipal Court.

Strategic Goal 5 – Parks and Beautification.

Objective 5.1 – Develop and enhance Community Events: There are funds in the Parks Department ($7,000) for special events including Trunk or Treat, Christmas with Santa, Easter Egg Hunt, a Summer event, and for the newly created Farmers Market. There are also funds for Parks Board to work with staff on recommending additional equipment to the new park ($7,300), a tree planting event ($4,000), and to work with a consultant to complete a Parks Master Plan or apply for another Texas Parks and Wildlife grant ($20,000).

Objective 5.2 – Enhance the beautification of the community: The Code Enforcement/Health Department budget has funds for the KNFB Committee to use forbeautification projects ($5,000). There are also funds for the Committee to work with a consultant to apply for a TxDOT Green Ribbon grant or Governor’s Excellence Award grant ($12,000) for further beautification projects at our entrance corridors.

Strategic Goal 6 – Advance our Interests.

Objective 6.1 – Improve Communication: There are funds in the budget to continue the community newsletter (Country Buzz) as well as to continue to make improvements the City website. The City is utilizing our social media platform more often than in years past.

Objective 6.3 – Develop an Economic Development Plan: There are no specific funds in the proposed budget, but staff will continue to work with commercial developers to try to get some economic development accomplished.

Conclusion

In summary, the Fiscal Year 2023-2024 budget reflects the City Council Strategic Goals and Objectives. There is a decrease in property tax revenue due to the disannexation of the Falcon Ridge subdivision, but there is a slight increase projected for franchise fees and permits revenue. There is a significant increase projected in sales tax that is consistent with the last two fiscal years, and to court fines and other revenue due to the ILA’s with the City of Boyd. The budget does add two and one-half (2.5) FTE’s to help address the increased demands for service of the growing community. I would like to extend my thanks to our City Secretary, Brooke Boller, City Operations Administrator, Joshua Barnwell, Municipal Court Administrator, Susan Greenwood, and our contract Finance Director, Michele Sanchez, for all their work on the preparation of this budget. I also want to thank the City Council and the residents of New Fairview for the honor and privilege of serving as the City Administrator. I appreciate the trust and confidence that has been bestowed on me and I look forward to implementing this budget to the best of my abilities.”