Unofficial New Fairview Special City Council Meeting brief of September 10, 2024.

All Council members present.

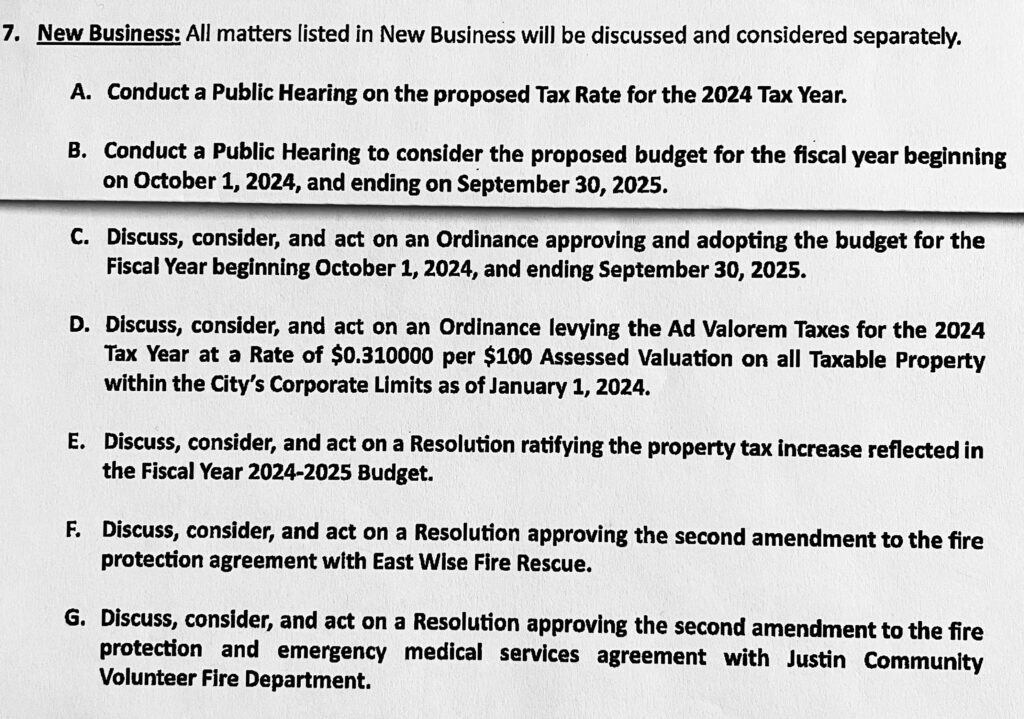

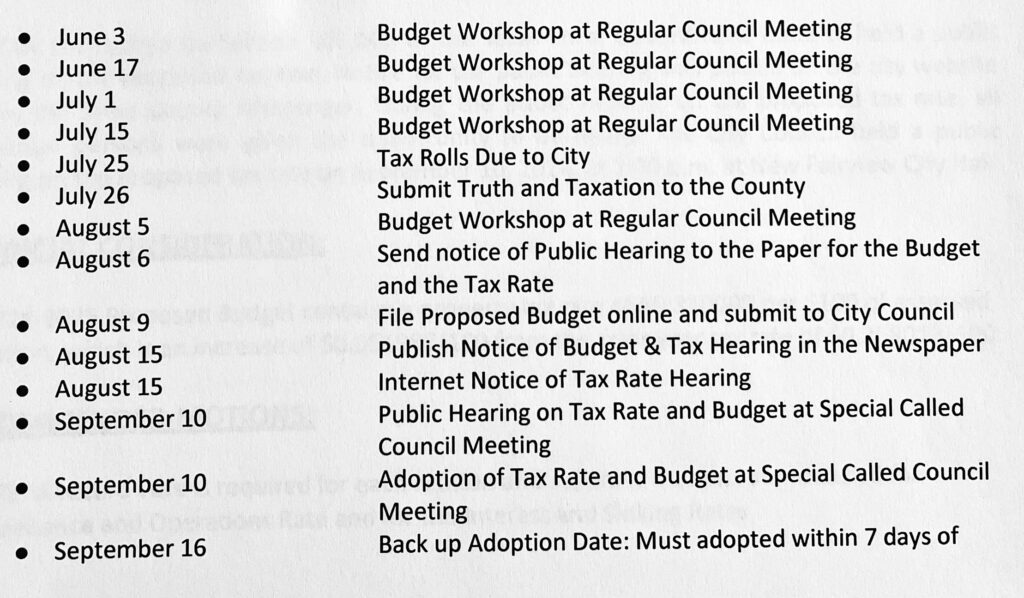

Agenda item 7A and 7B public hearings for the tax rate and budget. Michele Sanchez gave a presentation on the tax rate. John Cabrales did the presentation for the proposed budget. There were no citizen comments.

Agenda items 7C and 7D is for the 2024/2025 fiscal year budget (October 1, 2024 to September 30, 2025) and a .31 tax rate to fund the budget. Both were approved by Council.

(In accordance with Texas state code both items were voted on by a roll call vote for each individual agenda item. Council Members Steven King, Pete Kozlowski, Sarah Adams, Alisa Scheps, and Mayor John Taylor voted YES for the proposed budget and a tax rate of .31. Council Member Harvey Burger voted NO on both items.)

Agenda item 7E. A resolution ratifying the property tax increase was approved by a roll call vote.

(The fiscal year 2024-2025 adopted budget will raise taxes approximately .052; a little over five cents per $100 valuation. This agenda item required two motions with a roll call vote on each motion. The first motion to ratify the M&O tax rate of $0.206973 per $100 valuation was approved by Council and Mayor with one NO vote by Council Member Harvey Burger. The M&O, Maintenance and Operations, portion of the tax rate funds the daily operations of the city.

The second motion to ratify the I&S tax rate of $0.103027 per $100 valuation was unanimously approved by Council and Mayor. The I&S, Interest and Sinking, portion of the tax rate funds the debt payments the city is responsible for during the fiscal year. Adding M&O and I&S together is the total tax rate. .206973 + .103027= .31. The .31 tax rate is .052 higher than the 2023-2024 rate. This is an increase of $52 per $100,000 assessed valuation. $100,000 X .00052= $52 increase. A full rate calculation example at the approved FY 2024-2025 .31 tax rate for a $100,000 assessed valuation is $310.

$100,000 X .0031= $310.

For a tax rate based on a $100 valuation always move the decimal two places to the left to calculate full assessed valuation taxes before exemptions.

A random valuation number tax cost calculation example.

$285,042 X .0031= $883.63)

Agenda item 7F. Council unanimously approved the second amendment with East Wise Fire Rescue.

(East Wise Fire Rescue “does-business-as” New Fairview Fire Rescue. The second amendment increases the amount the city of New Fairview pays NFFR to provide fire protection, fire suppression, emergency medical, and rescue services to the annual sum of $96,000; to be paid at a monthly rate of $8,000.)

Agenda item 7G. Council unanimously approved the second amendment to the agreement with Justin Community Volunteer Fire Department.

(New Fairview will pay JCVFD $2000 a month for an annual sum of $24,000. This agreement provides fire, rescue, and ambulance services to the Denton County side of New Fairview. There is also a new provision in the second amendment that JCVFD will be automatically dispatched as a backup to any structure fire in New Fairview.)

“Since June the City Council and City Staff have been working on the budget for the next fiscal year. Raising taxes to offset a $72,000,000 devaluation was taken seriously by all involved. At the end of this meeting Council Member Sarah Adams said “The hardest day of the year is behind us”. This statement shows the serious responsibility the Council has for financial oversight of the City. We do not take our civic duty lightly. The adopted budget does an excellent job of explaining our challenges and documenting revenues/expenditures. It is progressive and transparent. In the past, and from other entities, I have read too many budgets that were difficult to comprehend with little or no explanation. Our adopted budget, and the two prior, are documents I am especially proud of. They reflect a City Staff and Administrator with a high degree of municipal professionalism. I congratulate them for an outstanding job. And I sincerely Thank each of them for their teamwork and service to New Fairview.